It is important to understand that profit reported on a company’s income statement does not equate to cash flow. Understanding a company’s cash –cycle can be vital to truly understanding and assessing how the company is doing overall.

It is important to understand that profit reported on a company’s income statement does not equate to cash flow. Understanding a company’s cash –cycle can be vital to truly understanding and assessing how the company is doing overall.

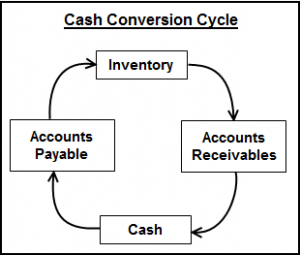

The cash cycle is an important component to understand when assessing a company’s operations and for understanding and assessing risk. We often look to the cash conversion cycle, which is a measure of how fast the company can convert purchased inventory into cash and collecting trade accounts receivable to generate cash. In other words, it measures how long cash is tied up from purchasing inventory before inventory is sold and cash is collected from customers. A long cash conversion cycle can be an indication of problems.

Cash Conversion Cycle

The cash conversion cycle has three distinct parts.

Days Sales in Inventory

The first part of the cycle represents the current inventory level and how long it will take the company to sell this inventory. This is calculated by using the days inventory outstanding calculation. In order to calculate the days inventory outstanding, we must first calculate the company’s inventory turnover. The inventory turnover measures the number of times inventory is sold in a given time period, typically measured in a one-year period and is a good gauge of inventory quality and management. For example, a poor turnover (low number) may be an indication of obsolete inventory, poor inventory management, or inefficient purchasing. Poor turnover could also be an indication of competitive products overtaking market share. Inventory turnover is significant indicator to monitor, since gross profit is earned each time inventory turns over.

Inventory turnover is calculated by dividing inventory by cost of goods sold. To convert the inventory turnover to days sales in inventory, multiply the inventory turnover by 365 days.

Days Sales in Receivables

The second stage of the cash cycle is the days sales in receivables calculation. This measures the amount of time it takes to collect the cash from credit sales. This calculation, aka Days sales outstanding, shows the efficiency of a company’s collections efforts. Simply stated, it indicates how quickly a company can collect cash from its customers, with a lower the number indicating efficient collection processes and procedure. The quicker trade receivables can be converted into cash, the faster these resources are available for use elsewhere within the business (i.e. to pay down debt, invest in fixed assets/expansion and etc.).

Days sales in receivables is calculated by dividing the ending accounts receivable by the total credit sales for the period and multiplying it by the number of days in the period. Most often this ratio is calculated at year-end and multiplied by 365 days.

Days Payable Outstanding

The third stage measures how the length of time a company has taken to pay its current vendors for inventory and other goods purchases and measures how well a business is managing its accounts payable. The lower the ratio, the quicker the business is paying its liabilities. It also indicates the average payment terms granted to a company by its suppliers. The higher the ratio, typically indicates that that the company is getting better credit terms from its suppliers. From a company’s prospective, an increase in days payable outstanding is an improvement (as the company doesn’t have to pay its suppliers as rapidly as it had to in the past) and a decrease is deterioration.

The days payable outstanding is calculated by dividing average accounts payable by cost of goods sold at year-end and multiplied by 365 days.

Create a Healthier Business

The timely managing of cash flow is a vital skill for sustaining a successful business. Reporting profit is great, but cash is king, and is needed to pay employees, suppliers, rent, and investors. Understanding and managing your cash conversion cycle can identify potential problems and alert management that corrective action is needed, which will keep your business healthier and more valuable.